What Do Domestic Foreign Businesses Need To Do To Register In Arkansas

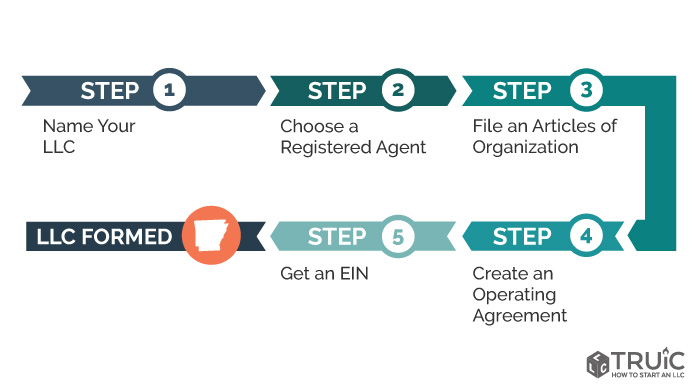

Starting an LLC in Arkansas is Easy

LLC Arkansas - To showtime an Arkansas LLC, you'll need to file your Document of Organization with the Arkansas Secretary of State. You can apply online, by mail, or in person for $50. The Certificate of Organization is the legal document that officially creates your Arkansas limited liability company.

Follow our step-past-stride How to Start an LLC in Arkansas guide to get started today. You lot can learn more well-nigh LLCs and their benefits in our What Is an LLC guide.

Step 1: Name Your Arkansas LLC

Choosing a company name is the start and most important pace in setting up an LLC in Arkansas. Be sure to choose a proper noun that complies with Arkansas LLC naming requirements and is easily searchable past potential clients.

1. Follow the naming guidelines:

- Your name must include the phrase "limited liability company" or 1 of its abbreviations (LLC or L.50.C.).

- Your proper noun cannot include words that could confuse your LLC with a government agency (e.thou., FBI, Treasury, State Department, etc.).

- Restricted words (eastward.g., Bank, Attorney, Academy) may require boosted paperwork and a licensed individual, such as a doctor or lawyer, to be part of your LLC.

- Your name must be distinguishable from any other Arkansas limited liability company, corporation, or limited partnership.

ii. Arkansas LLC Name Availability: Brand sure the proper name you lot want isn't already taken past doing an Arkansas LLC Search on the Secretarial assistant of State'southward website.

To learn more about searching for an Arkansas LLC name, read our full guide.

3. Is the URL bachelor? We recommend that you lot check online to meet if your business organisation proper noun is available as a web domain. Fifty-fifty if you don't plan to make a business organisation website today, you lot may want to buy the URL in social club to prevent others from acquiring it.

Discover a Domain At present

At present that you accept verified your proper noun and secured the URL you may select a professional service to complete the LLC formation process for you. We recommend using one of these professional services:

FAQ: Naming an Arkansas LLC

What is an LLC?

LLC is short for limited liability company. It is a elementary business structure that offers more flexibility than a traditional corporation while providing many of the same benefits.

An LLC is one of several business organization structures, such every bit a sole proprietorship, partnership, and corporation (which includes C corp and Due south corp). For more information, read our What Is an LLC guide.

Watch our video: What Is an LLC?

How do I proper noun my Arkansas LLC?

You must follow the Arkansas LLC naming guidelines when choosing a name for your LLC:

- Include the phrase "limited liability visitor" or 1 of its abbreviations (LLC or L.L.C.).

- Do not use words that could confuse your business with a government agency (FBI, State Section, CIA, etc.).

- Receive the proper licensing when using the words such as lawyer or md.

If you are having problem coming upwards with a proper noun for your LLC use our LLC Name Generator. That will not merely notice a unique proper noun for your business but an available URL to match.

Subsequently you go your business concern name, your adjacent stride is getting a unique logo. Go your unique logo using our Gratuitous Logo Generator.

Do I need to go a DBA or trade proper noun for my business concern?

Most LLCs do non need a doing business as (DBA) name. The name of the LLC tin serve as your company'southward brand proper name and you tin take checks and other payments under that name besides. However, you may wish to register a DBA if you lot would like to conduct business organisation nether another name.

To acquire more about DBAs in your land, read our How to File a DBA guide.

Stride 2: Choose a Registered Agent in Arkansas

You arerequired to nominate an Arkansas registered agent for your LLC.

What is a registered agent? A registered amanuensis is an individual or business entity responsible for receiving important tax forms, legal documents, notice of lawsuits, and official authorities correspondence on behalf of your business. Retrieve of your registered agent as your business concern'southward point of contact with the state.

Who can exist a registered agent? A registered agent must be a resident of Arkansas or a corporation, such as a registered agent service, authorized to transact business in Arkansas. You may elect an individual within the company including yourself.

To learn more than about Arkansas Registered Agents, read our total guide.

Recommended: ZenBusiness provides the first year of registered amanuensis service free with LLC formation ($39 + Country Fees)

FAQ: Nominating an Arkansas Registered Agent

Can I exist my own registered agent in Arkansas?

Is a registered agent service worth it?

Using a professional registered amanuensis service is an affordable way to manage government filings for your Arkansas LLC. For nigh businesses, the advantages of using a professional service significantly outweigh the annual costs.

For more data, read our article on Arkansas registered agents.

Stride 3: File the Arkansas LLC Certificate of Organization

To register your Arkansas LLC, you will demand to file Form LL-01 - Certificate of Arrangement with the Secretarial assistant of Country. You tin apply online, by postal service, or in person.

Now is a good fourth dimension to decide whether your LLC will be member-managed vs. managing director-managed.

Pick 1: File Online With the Arkansas SOS Corporations Online Filing Arrangement

File Online

Select "Certificate of Organization for Domestic LLC - LL-01" and select "Offset Grade"

- OR -

OPTION 2: File Form LL-01 by Mail or In Person

Download Form

Land Filing Price: $50, payable to the Secretary of State. (Nonrefundable)

Filing Address:

Arkansas Secretary of State

1401 W. Capital letter Ave.

Suite 250

Little Rock, AR 72201

For aid with completing the form, visit our Arkansas Certificate of Organization guide.

If you're expanding your existing LLC to the country of Arkansas, you will need to grade a Foreign LLC.

FAQ: Filing Arkansas LLC Documents

What is the processing time to grade my Arkansas LLC?

Within 48 hours online, or a week by mail service.

What is the difference between a domestic LLC and foreign LLC?

An LLC is referred to every bit a "domestic LLC" when it conducts business organisation in the state where it was formed. Unremarkably when we refer to an LLC nosotros are actually referring to a domestic LLC. A foreign LLC must be formed when an existing LLC wishes to expand its business organisation to another state.

Read our What Is a Foreign LLC commodity to learn more than.

How much does it cost to start an Arkansas LLC?

Step 4: Create an Arkansas LLC Operating Agreement

An operating agreement is not required for an Arkansas LLC, simply information technology'south a good practice to have one.

What is an operating agreement? An operating agreement is a legal document outlining the ownership and operating procedures of an LLC.

Why are operating agreements important? A comprehensive operating understanding ensures that all business owners are on the same page and reduces the chance of time to come conflict.

For more data on operating agreements, read our Arkansas LLC operating understanding guide.

FAQ: Creating an Arkansas LLC Operating Agreement

Exercise I demand to file my operating agreement with the land of Arkansas?

No. The operating understanding is an internal document that you should keep on file for hereafter reference. However, many states do legally require LLCs to have an operating agreement in place.

Footstep 5: Get an Arkansas LLC EIN

What is an EIN? EIN stands for Employer Identification Number. EINs are a nine-digit number assigned past the Internal Revenue Service (IRS) to help identify businesses for tax purposes. It is essentially a Social Security number for a business.

An EIN is sometimes referred to as a Federal Employer Identification Number (FEIN) or Federal Tax Identification Number (FTIN).

Why do I need an EIN? An EIN is required to:

- Open a business banking concern business relationship

- File and manage federal and state taxes

- Hire employees

What if I already take an EIN for my sole proprietorship? The IRS requires that sole proprietorships become a new EIN when converting to an LLC.

Where practise I get an EIN? You can get an EIN for free from the IRS. Getting an EIN is an piece of cake process that tin be done online or past mail service.

FOR INTERNATIONAL EIN APPLICANTS: You do not need a SSN to go an EIN. For more information, read our How to Get an EIN as a Foreign Person guide.

Pick 1: Request an EIN from the IRS

Apply Online

- OR -

Pick ii: Apply for an EIN by Postal service or Fax

Download Form

Mail to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

Fax: (855) 641-6935

Fee: Free

FAQ: Getting an Arkansas LLC EIN

How do I get an EIN if I don't have a Social Security number?

What tax structure should I choose for my Arkansas LLC?

Do I need an EIN for my LLC?

All LLCs with employees, or whatever LLC with more than one fellow member, must accept an EIN. This is required by the IRS.

Larn why we recommend always getting an EIN and how to get i for free in our Do I Demand an EIN for an LLC guide.

Take a question? Leave a Annotate!

Inquire us a question, tell us how we're doing, or share your experiences. Bring together the conversation in our Comment Section.

Take a question? Leave a Annotate!

Ask u.s.a. a question, tell us how we're doing, or share your experiences. Join the conversation in our Comment Section.

Considering Using an LLC Formation Service?

Nosotros reviewed and ranked the top v LLC formation services.

Detect out which is all-time for yous.

Best LLC Services

Important Steps After Forming an LLC

Split up Your Personal and Business Avails

When your personal and business accounts are mixed, your personal assets (your home, car, and other valuables) are at run a risk in the event your Arkansas LLC is sued. In business concern constabulary, this is referred to as piercing the corporate veil.

Yous can offset protecting your LLC in Arkansas with these steps:

1. Opening a business checking account:

- Separates your personal assets from your company's assets, which is necessary for personal nugget protection.

- Makes accounting and tax filing easier.

Need help finding your EIN for your bank application? Visit our EIN Lookup guide for help.

Recommended: Read our All-time Banks for Small Business review to detect the best national bank, credit marriage, business-loan friendly banks, ane with many brick-and-mortar locations, and more than.

2. Getting a business credit card:

- Helps categorize and dissever all business expenses for cease-of-year taxation purposes.

- Helps build your business credit score — an essential step toward getting a line of credit or concern loan in the future.

- Allows you to keep rails of department expenses past issuing multiple cards (with multiple budgets) to your employees.

For a closer await at business credit cards and their benefits, check out our review of the best minor business credit cards.

Recommended: Visit Divvy to use for their business organisation credit bill of fare and build your business credit quickly.

Apply With Divvy

For other important steps to protect your corporate veil, like properly signing legal documents and documenting company business, please read our corporate veil article.

three. Hiring a business accountant:

- Prevents your business from overpaying on taxes while helping you avoid penalties, fines, and other plush revenue enhancement errors

- Makes bookkeeping and payroll easier, leaving you with more than time to focus on your growing business

- Manages your business funding more effectively, discovering areas of unforeseen loss or extra profit

For more business organisation bookkeeping tools, read our guide to the best business bookkeeping software.

Get Business concern Insurance for Your Arkansas LLC

Concern insurance helps y'all manage risks and focus on growing your business. The almost mutual types of business insurance are:

- Full general Liability Insurance: A broad insurance policy that protects your business from lawsuits. About pocket-sized businesses get general liability insurance.

- Professional person Liability Insurance: A concern insurance for professional service providers (e.one thousand., consultants, accountants, etc.) that covers claims of malpractice and other business organisation errors.

- Workers' Compensation Insurance: A blazon of insurance that provides coverage for employees' chore-related illnesses, injuries, or deaths. In Arkansas, businesses with iii or more employees, excluding officers and LLC members, are required by law to have workers' compensation insurance.

Read our review of the best small business insurance companies.

Create Your Business Website

Creating a website is a large stride in legitimizing your business. Every concern needs a website. Even if you remember that your business organisation is too small or in an offline industry, if you don't have a website, you are missing out on a large percentage of potential customers and revenue.

Some may fear that creating a business website is out of their reach considering they don't have any website-edifice experience. While this may have been a reasonable fright back in 2015, web engineering has seen huge advancements in the past few years that makes the lives of small business owners much simpler.

Here are the chief reasons why you shouldn't delay building your website:

- All legitimate businesses have websites - full cease. The size or industry of your business does not matter when information technology comes to getting your business online.

- Social media accounts like Facebook pages or LinkedIn business organization profiles are not a replacement for a business website that you own and command.

- Website builder tools like the GoDaddy Website Builder have fabricated creating a basic website extremely uncomplicated. You don't need to hire a web developer or designer to create a website that yous can be proud of.

Using our website edifice guides, the procedure will exist unproblematic and painless and shouldn't accept you any longer than 2-three hours to complete.

Transport Out a Press Release

Printing releases are amidst the easiest and best ways to promote your business. They are also one of the most cost-effective strategies as they:

- Provides publicity

- Establish your brand presence on the spider web

- Amend your website's search engine optimization (SEO), driving more than customers to your website

- Are a one-time cost in terms of endeavor and money

- Accept long-lasting benefits

Go along Your Company Compliant

Arkansas Business organisation Permits and Licenses

To operate your Arkansas LLC you lot must comply with federal, state, and local government regulations. For instance, restaurants likely need health permits, edifice permits, signage permits, etc.

The details of concern licenses and permits vary from state to state. Make sure you lot read carefully. Don't exist surprised if there are short classes required as well.

Fees for business licenses and permits volition vary depending on what sort of license you lot are seeking to obtain.

Find out how to obtain necessary licenses and permits for your business or accept a professional service do it for you:

- Business License Guide: Use our detailed Arkansas Business License guide.

- Federal: Use the United states Small Business Administration (SBA) guide.

- State:Visit the Country of Arkansas'due south Professional Licensing webpage.

- Local: Contact your local county clerk and ask nigh local licenses and permits.

Recommended: If you are a first-fourth dimension entrepreneur, consider having a professional service research your business organization's licensing requirements. Read our best business license services review on Startup Savant.

Arkansas LLC Tax Filing Requirements

Depending on the nature of your business, you may exist required to annals for one or more forms of state tax.

Arkansas Sales Tax

If you are selling a physical product, yous'll typically demand to register for a seller'due south permit through the Arkansas Office of Taxation and Acquirement website.

This document allows a concern to collect sales taxation on taxable sales.

Sales revenue enhancement, likewise called "Sales and Use Tax," is a tax levied by states, counties, and municipalities on business transactions involving the exchange of certain taxable goods or services.

Read our Arkansas sales taxation guide to find out more than.

Arkansas Employer Taxes

If you have employees in Arkansas, you will have to register for Unemployment Insurance Tax through the Department of Employment Services. You will also demand to sign upwardly for Withholding Tax through the Office of Tax and Revenue.

FAQ: Boosted Taxes

What is the Arkansas Franchise Taxation?

The Franchise Taxation is a state tax on every business organisation that conducts business in Arkansas, including LLCs.

Federal LLC Tax Filing Requirements

Most LLCs volition need to report their income to the IRS each year using:

- Form 1065 Partnership Return (about multi-member LLCs use this form)

- Form 1040 Schedule C (near unmarried-member LLCs utilize this form)

How y'all pay yourself equally an owner will as well affect your federal taxes. Visit our guide to acquire more about how to pay yourself from your LLC.

Read ourLLC Tax Guide to acquire more near federal income taxes for LLCs.

Arkansas LLC Franchise Tax

In Arkansas, all LLCs are required to file and pay an annual Franchise Revenue enhancement. This can exist done online or by mail.

OPTION 1: File Online With the Arkansas Department of Finance and Assistants Franchise Taxation Filing Organization

File Online

- OR -

Option two: File past Mail service

Franchise Tax Forms

Fee: Gratis

Mail to:

Business organization and Commercial Services

P.O. Box 8053

Little Rock, AR 72203

Tax Calculation: Arkansas imposes a $150 annual franchise taxation on LLCs conducting business in their state.

Due Date: This tax must be paid by May 1 of the post-obit year

Late filing: Fee is $25 plus an involvement calculation on the form

FAQ: Arkansas LLC Franchise Revenue enhancement

Arkansas Franchise Tax Corporeality

All LLCs owe $150 annually in Arkansas Franchise Tax.

Avoid Automatic Dissolution

LLCs may confront fines and even automated dissolution when they miss one or more state filings. When this happens, LLC owners gamble loss of limited liability protection. A quality registered agent service tin can help prevent this effect by notifying you of upcoming filing deadlines and by submitting reports on your behalf.

Recommended: ZenBusiness offers a reliable registered agent service and excellent customer support. Learn more past reading our ZenBusiness Review.

Hiring Employees in Arkansas

If you program to hire employees for your Arkansas LLC, stay compliant with the law by following these steps:

- Verify that new employees are able to piece of work in the The states

- Report employees as "new hires" to the state

- Provide workers' compensation insurance for employees

- Withhold employee taxes

- Print workplace compliance posters and identify them in visible areas of your workspace

FAQ: Hiring Employees in Arkansas

What is the minimum wage in Arkansas?

The minimum wage in Arkansas is $11.00 per hour.

How often do I need to pay employees in Arkansas?

Arkansas requires that employees must be paid on a semi-monthly basis.

Still, wages can be paid monthly if both of the following are true:

- The employee makes more than $25,000 in gross salary

- The employer makes more than than $500,000 in gross income

Small-scale Business Trends

Get Help Starting a Business in Arkansas

We understand that creating an LLC and getting your business upward and running comes with many challenges. To help you succeed, we compiled the best local resources in every major metro area in Arkansas. You can go free assistance in the following areas:

Fayetteville | Hot Springs | Jonesboro | Petty Rock

Women in Business Tools and Resources

Learn nigh the electric current US business organization trends so you tin brand the most informed business decisions.

Women in Business Tools and Resources

If you accept a woman-owned business, many resources are available to help y'all concentrate on your business's growth:

- Funding - (i.e., grants, investors, loans)

- Events - (i.east., conferences, meetups)

- Guides - (i.e., business germination, personal growth)

- Back up - (i.e., advice, communities, business concern strategies)

Our information and tools will provide educational sources, allow yous to connect with other women entrepreneurs, and help y'all manage your business organisation with ease.

Gratis LLC Legal Forms

TRUiC offers a number of free LLC legal forms to help with creating documents similar:

- Operating agreements

- LLC resolutions

- Hiring documents, including:

- Employment contracts

- Independent contractor service agreements (ICSA)

- Not-disclosure agreements (NDA)

All you'll need to do to download the forms is sign upwardly for the TRUiC Business Middle, which is besides free, forever.

How to Build Business Credit

Learning how to build business organisation credit tin help y'all get credit cards and other business funding options in your business organization's name (instead of yours), with better interest rates, higher lines of credit, and more.

TRUiC's Modest Business Tools

TRUiC believes business tools should be complimentary and useful. Our tools help solve business organization challenges, from finding an idea for your business organization, to creating a business plan, writing an operating agreement for your LLC, and more.

Check out TRUiC'south small business tools:

- Business concern Proper noun Generator

- Business Idea Generator

- Gratuitous Logo Maker

- Operating Understanding Tool

- Business concern Plan Generator

- Entrepreneur Quiz

More Arkansas LLC Information

Arkansas Foreign LLCs

Forming a foreign LLC allows your company to operate equally one entity in multiple states. If you have an existing LLC and want to exercise business in Arkansas, y'all will demand to register equally a foreign LLC. This can be washed online, past mail, or in person.

Choice ane: File Online With the Arkansas SOS Corporations Online Filing Arrangement

File Online

Curl to "Foreign LLC" and select the "App. for Document of Registration of For. LLC - FL-01"

- OR -

OPTION 2: File by Mail or In Person

Download Form

Fee: $270 online, $300 by mail or in person (Nonrefundable)

Mail service or Submit In Person:

Arkansas Secretary of State

1401 West. Capitol Ave.

Suite 250

Picayune Rock, AR 72201

How to Obtain a Document of Good Continuing in Arkansas

A Certificate of Expert Standing verifies that your Arkansas LLC was legally formed and has been properly maintained. Several instances where you might need to go one include:

- Seeking funding from banks or other lenders

- Forming your business every bit a foreign LLC in another state

- Obtaining or renewing specific business organization licenses or permits

You tin can society an Arkansas Certificate of Skillful Continuing online.

Order a Document Online from the Arkansas Secretarial assistant of Land

Social club Online

Fee: $25 (Nonrefundable)

How to Dissolve an LLC in Arkansas

If at whatsoever point in the futurity y'all no longer wish to conduct business with your Arkansas LLC, it is important to officially dissolve it. Failure to do and so in a timely fashion can issue in tax liabilities and penalties, or even legal trouble. To dissolve your Arkansas LLC, in that location are three broad steps:

- Follow your LLC operating agreement

- Close your business organization tax accounts

- File the Arkansas Articles of Dissolution

When you are prepare to dissolve your LLC, follow the steps in our Arkansas LLC Dissolution Guide.

- Guide to Starting a Business organization in Arkansas

- Top V LLC Formation Services Compared

- Toll to Form an LLC in Arkansas

Cardinal Terms for Entrepreneurs

LLC: An LLC is a U.s.a. business structure that offers the personal liability protection of a corporation with the laissez passer-through taxation of a sole proprietorship or partnership.

DBA: A DBA, or doing business as name, is any name a concern operates nether that isn't its legal name.

Partnership: A partnership is an breezy business concern structure owned by more one individual that doesn't provide personal liability protection.

What Do Domestic Foreign Businesses Need To Do To Register In Arkansas,

Source: https://howtostartanllc.com/arkansas-llc

Posted by: spencerserow1947.blogspot.com

0 Response to "What Do Domestic Foreign Businesses Need To Do To Register In Arkansas"

Post a Comment